A Biotech Billionaire Has Taken Big Positions In These Small Stocks

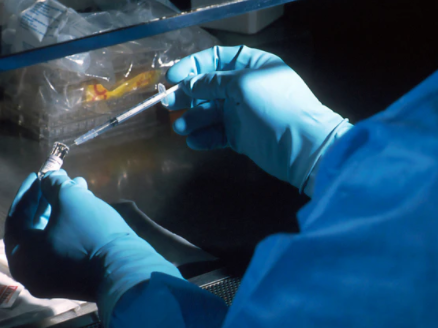

With his Perceptive Advisors hedge fund, which specializes in taking big positions in small-cap biotech stocks, billionaire Joseph Edelman has proven himself to be one… Read More »A Biotech Billionaire Has Taken Big Positions In These Small Stocks